The Tax Bizz 3rd Annual

Business Mastery Event!

The Tax Bizz 3rd Annual Business Mastery Event!

Open for all tax professionals

we've got you covered!

This event is designed to provide you with valuable insights, strategies, and practical tips to help you accelerate the growth of your tax business.

Whether you are a beginner, intermediate, or experienced tax professional or an aspiring entrepreneur in the tax industry, this event is tailored to meet your specific needs and goals.

Open for all tax professionals

EVENT DETAILS

Date: November 4th

Registration: 7:30 am

Event: 8:00 am to 7:00 pm

Location:

Embassy Suites,

10220 Palm River Rd, Tampa, FL 33619

WHAT YOU WILL LEARN

Marketing and Business Automation

Effective marketing and branding techniques

Marketing on Instagram/Facebook

Business planning and strategy for tax professionals

Effective Marketing Strategies for Tax Professionals

Maximizing Client Satisfaction and Retention

Building a Strong Foundation for Your Tax Business

Developing Additional Revenue Streams

Client acquisition and retention strategies

How to Automate you tax business

Leveraging Technology for Efficiency and Growth

WHAT YOU WILL LEARN

Tax Education and Tax Law Training

Tax education training covers a wide range of topics to provide individuals with the knowledge and skills necessary to navigate the complex field of taxation.

Earned Income Tax Credit, Child Tax Credit, and Additional Child Tax Credit

Tax Law Fundamentals

Tax Compliance

Self-Employment Tax

Business Taxes

Understanding the basics of income tax

Standard Deduction

Deductions, credits, and different types of income, such as wages

Business income

Investment Income

Rental income

Updates and Changes in Tax Laws

State and Local Taxation

Compliance and regulatory updates

Navigating Tax Regulations and Compliance

IRS Representation and Tax Controversies: Tax laws, Ethics, and Professional Responsibility

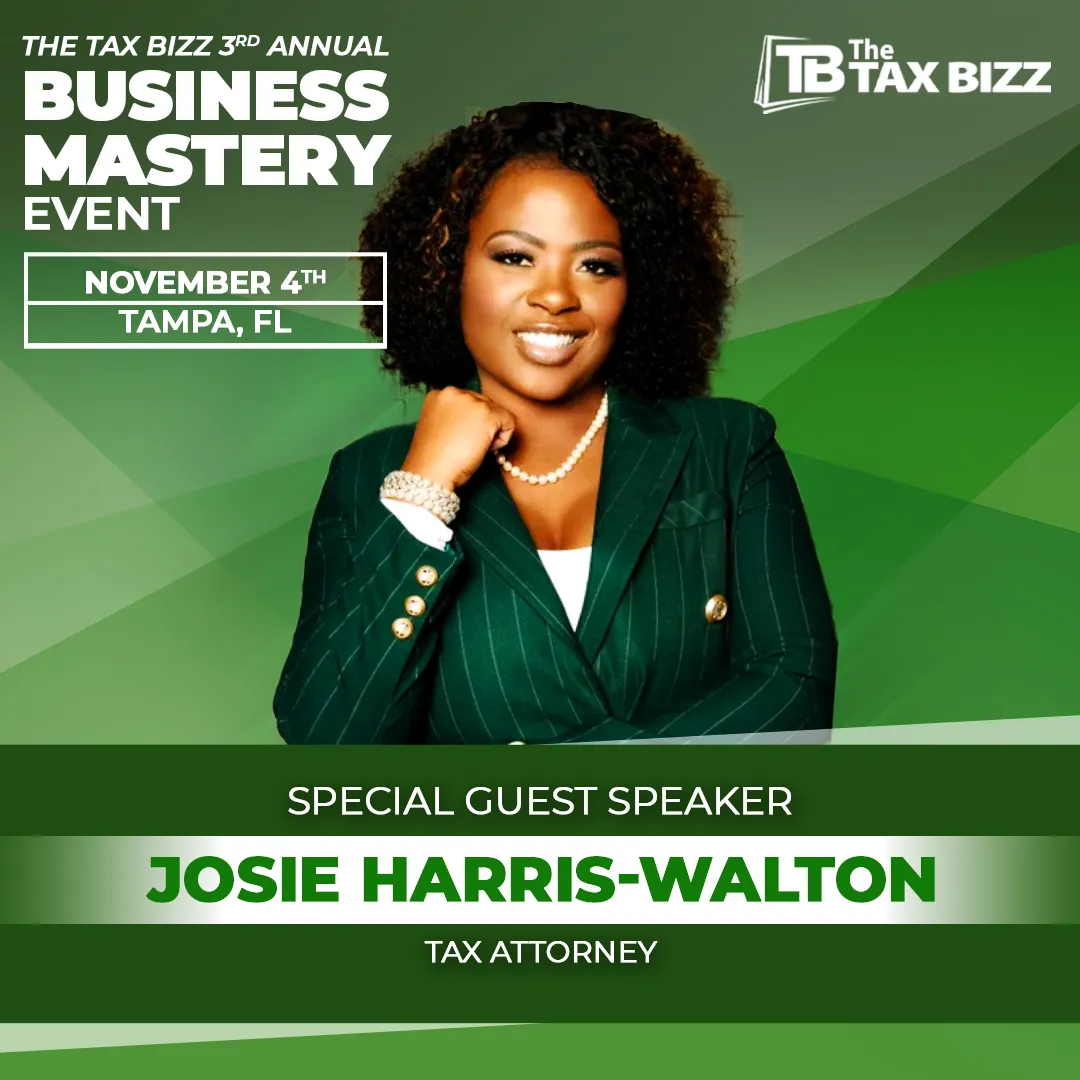

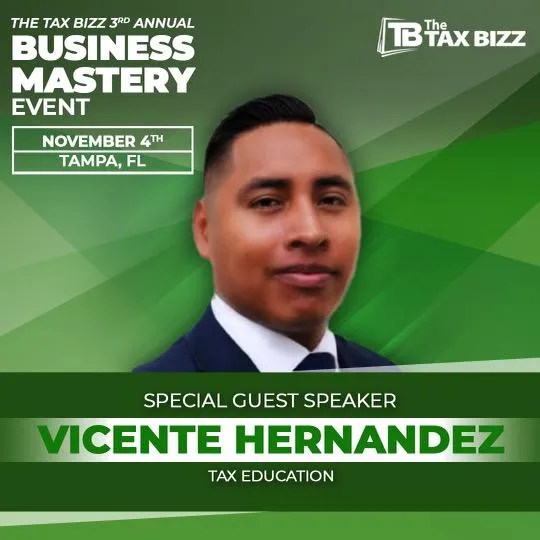

Speakers

Host: Erikka Knowles

Founder and CEO Weston Hill

Early bird discounts and limited seats are available,

so make sure to reserve your spot as soon as possible.

SPECIAL GUESTS

Early bird discounts and limited seats are available,

so make sure to reserve your spot as soon as possible.

The Tax Bizz Software LLC Ⓒ I All Rights Reserved 2023

Designed by Lead Pro Giants